Since 2023 it will also be necessary to communicate series to the Tax Authority for those who make the self-invoicing.

In a simple way, self-invoicing is a different way of invoicing, where the customer passes the invoice on behalf of the supplier.

Self-invoicing happens when the seller has a small or informal activity and for this reason does not have an administrative structure to invoice according to CIVA.

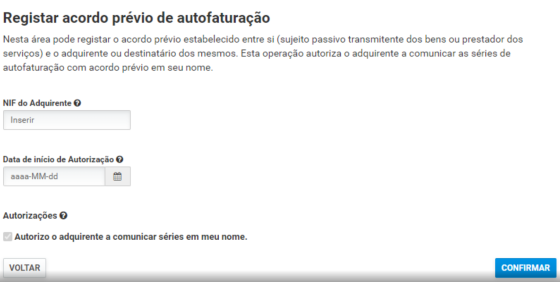

Different series should be used for each existing agreement, i.e. the acquirer must make separate communications by each supplier or service provider with whom he has self-invoicing, obtaining the respective validation codes, so that they appear differentiatedATCUD billing documents.

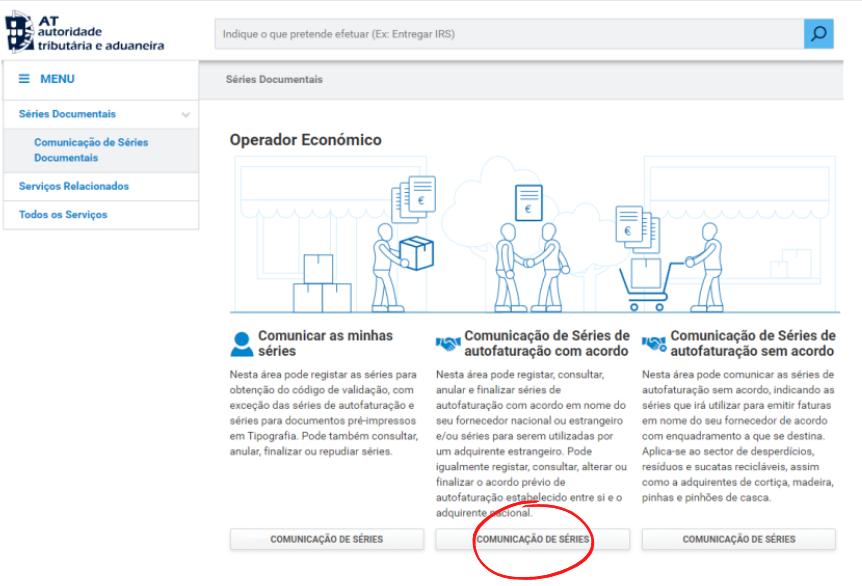

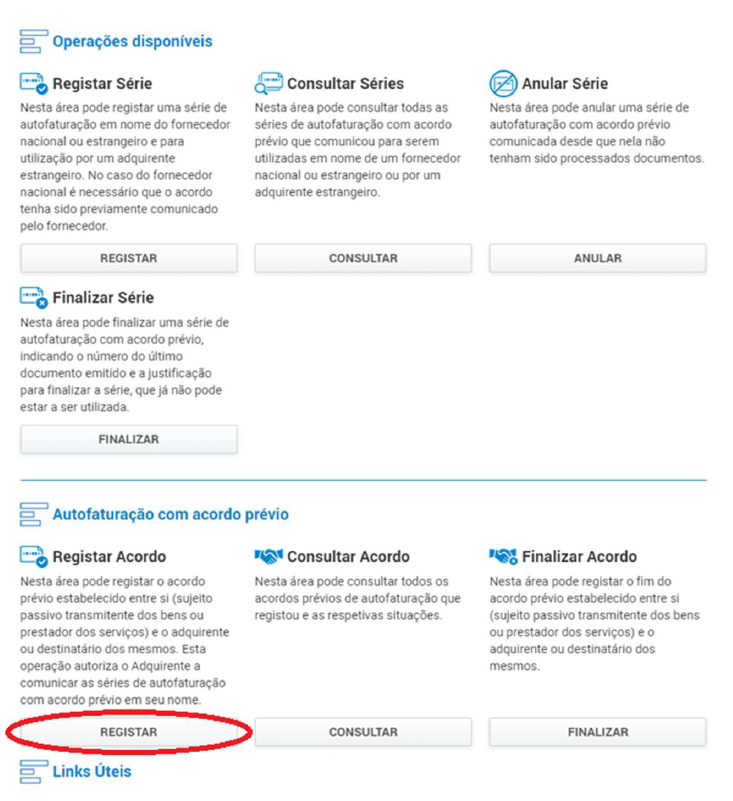

Communication of self-invoicing series with agreement

After the existence of a self-invoicing agreement has been registered by the taxable person transferring the goods or providing the services, the purchaser may communicate the series and obtain the respective validation codes to be used in the processing of invoicing documents under that agreement.

Thus, to carry out the communication of self-invoicing series you should access the Finance Portal (AT) and follow the steps indicated.