From 2024, the deadline for submission of the SAF-T file will be until the 5th of each month.

Essentially, this measure requires companies and self-employed workers to submit documents to the Tax Authority, through the SAF-T file by the 5th day of the month following their issuance, starting in 2024.

What does SAF-T include?

The Billing SAF-T includes information about sales documents, transport documents, budgets, pro forma invoices, receipts, taxes, customers, and vendors. This file, in XML format, must be submitted monthly to the Tax Office.

Who is required to submit the Billing SAF-T?

The delivery of the SAF-T is mandatory for legal entities that carry out commercial, industrial or agricultural activities. This obligation also applies to taxable persons using a certified invoicing program.

Therefore, all those who have the obligation to issue invoices or transactions subject to VAT must communicate the elements of the invoices to the Tax Authority. This obligation also includes those who are established in another Member State or third country, provided that the transactions involve consumers located in Portugal.

In 2023, the deadline for submitting the SAF-T file to the AT was extended until the 8th of each month.

How to send the SAF-T file?

Step 1

Go to E-invoice para enviar o ficheiro SAF-T.

Step 2

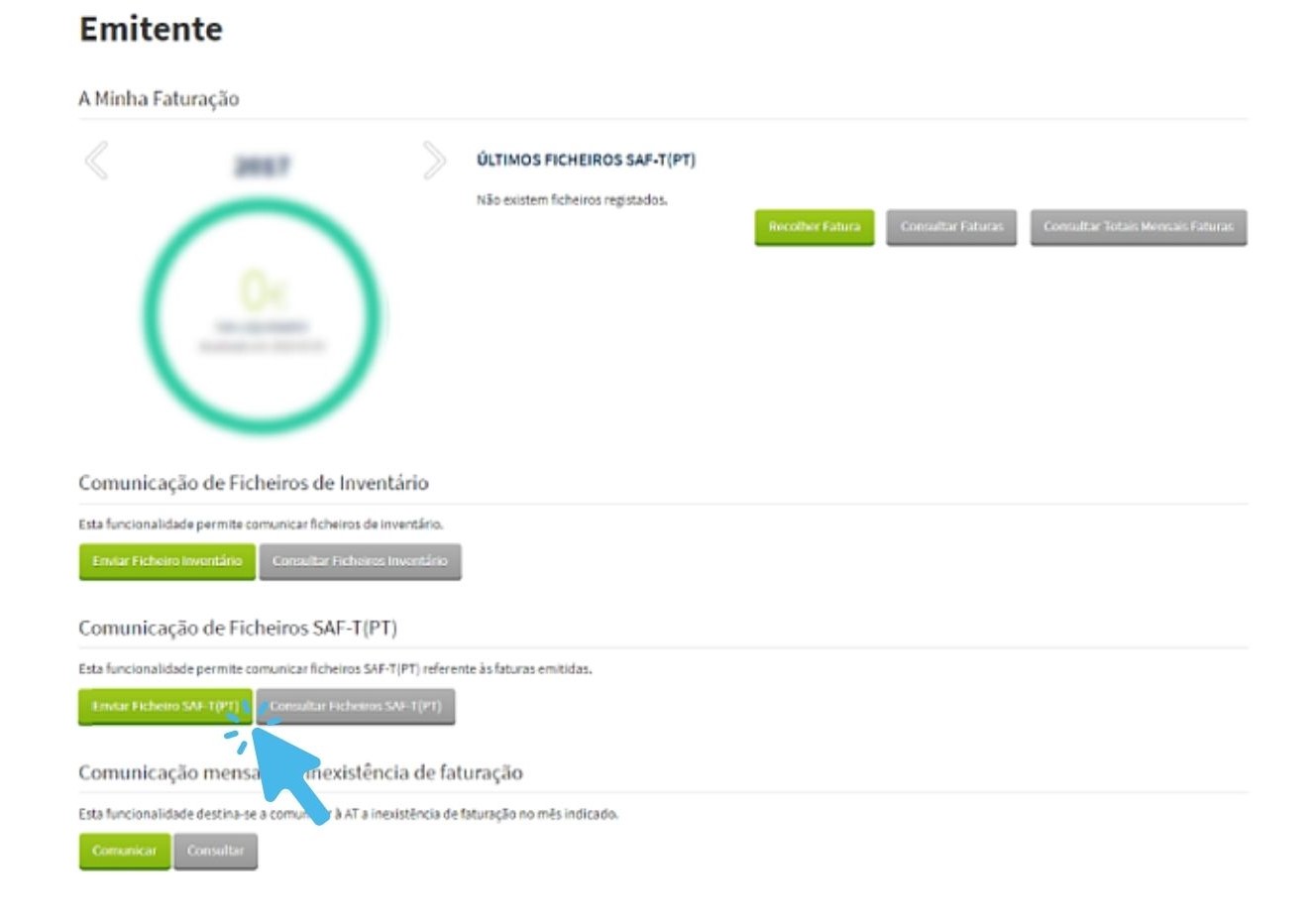

Select the option Issuer.

Step 3

Authenticate yourself with the access data of the Finance portal.

4th Step

Once you're on the page, click "Send SAF-T file“.

5th Step

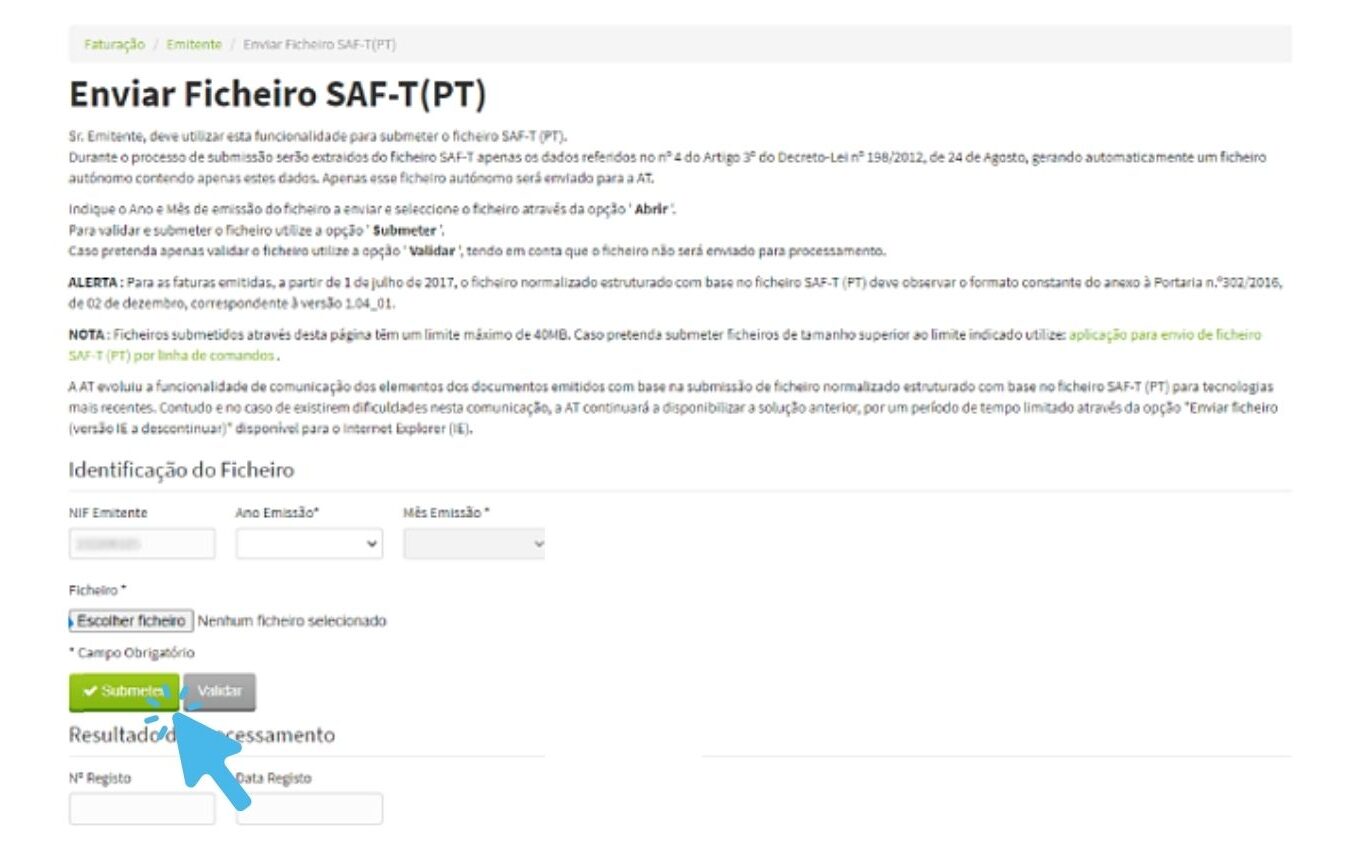

Enter your NIF, month and year of issuance. Then, select the file from the option "Choose File" and submit.

With the SAF-T delivery deadline changing in 2024, it is important for companies to be prepared to meet this obligation on time. Remember, timely delivery of SAF-T not only ensures tax compliance but also helps avoid potential fines.

Finally, check out all this month's tax obligations: