The deadline for confirmação ou atualização da composição do agregado familiar em 2024, or reporting any changes, is until February 15.

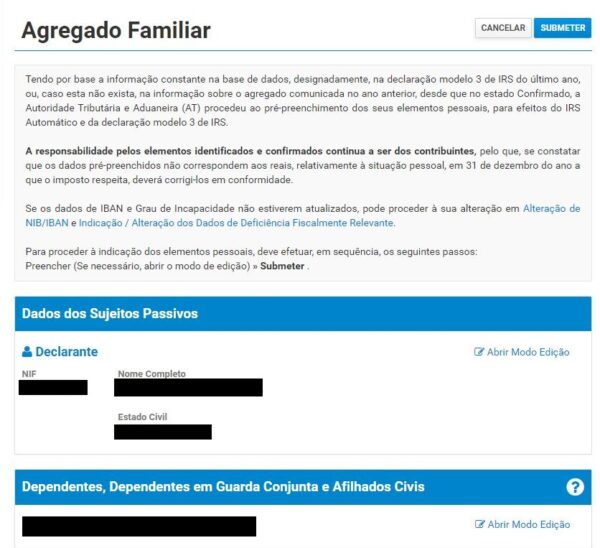

The household needs to be updated regularly to reflect changes in their family situation, such as births, deaths, marriages, divorces, and changes of residence. Updating the household in 2024 is important to ensure that the data is accurate and in line with current legislation and regulations. In addition, it may be necessary to access benefits and services that depend on up-to-date household information.

Communications you must make, if there are:

- Marriage

- Births

- Divorce or separation (in the case of property sharing)

- Purchase own and permanent housing

- Children who are no longer considered dependent (e.g. because they reach the age of 26 or have received more than €9,870 annually)

- If you have dependents in joint custody with alternate residence, established in an agreement regulating the exercise of parental responsibilities

Who are considered dependent in the IRS

The following are considered dependent:

- Children, adopted and stepchildren not emancipated or under guardianship

- Children, adopted and stepchildren provided desde que não tenham mais de 25 anos de idade nem recebam anualmente mais de 14 salários mínimos (10.640 euros, no IRS de 2023)

- Children, adopted and stepchildren unfit for work and to raise livelihoods

- Civil godsons.

Thus, for the submission of the IRS in 2024, those who reach the age of 26 or who have received more than €10,640 in the total year 2023 are no longer considered dependents.

Note: Dependents cannot simultaneously be part of a household.

How to communicate the household

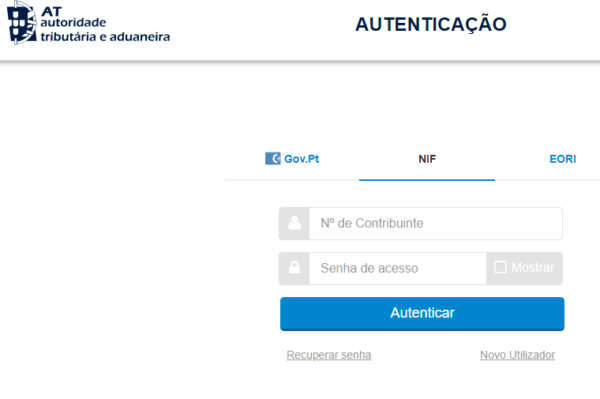

Go to Finance Portal (AT):