We remind you that the deadline for the validation of invoices in the E-Fatura is until 26 de fevereiro de 2024.

Although most expenses are reported automatically, depending on the sector of activity, there are some that must be validated manually to guarantee deductions and monetize the IRS refund.

In this article we explain step by step how you can do it!

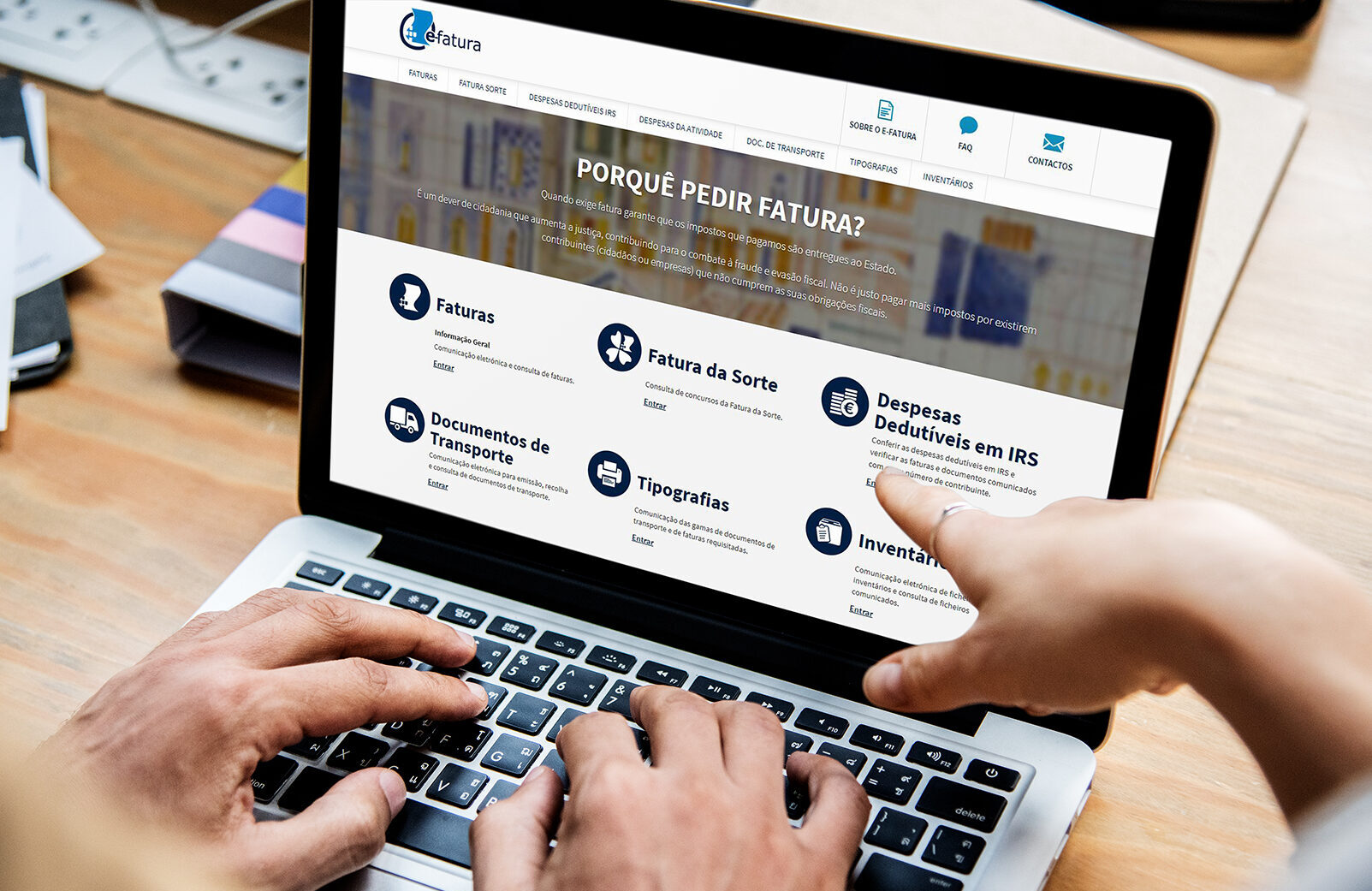

Invoice validation in e-Fatura

To validate invoices you must be registered in the Finance Portal (AT). If you are a new user you must register and wait for the access password to be sent to your address.